63% of people with a smartphone have at least one financial app, and 70% check their bank’s app at least once a week. That’s a HUGE change from just a decade or so ago! Embracing technology can make managing your money easier and more convenient, helping you to get out of debt, save money, and make quick, secure payments in less than a second. It’s difficult to believe that smartphones only become commonplace in the last ten years, yet already they have transformed how people live their lives, something that banks are taking advantage of for the benefit of their customers.

Contactless Payments

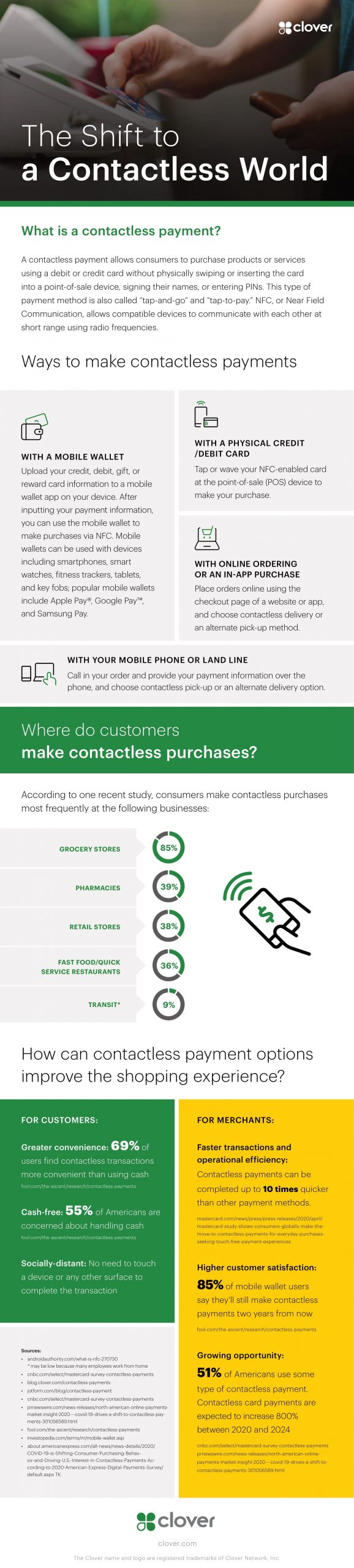

It’s fair to say that America has been behind on contactless card payments for some time now compared to countries like the UK and Australia who have been embracing the convenient tech for years.

Infographic created by Clover Network, a POS system provider.

Contactless payments are completed in less than 5/10ths of a second, making them ideal for speeding up lines in shops and for quickly buying a ticket on public transport. Contactless payments are made possible by what is called radio frequency identification (RFID) technology and a built-in antenna in the card that communicates with an RFID reader. America is due to catch up with other countries, as it’s predicted that by 2022, contactless card payments will make up a third of all electronic payments in America, according to The Economist.

NFC Technology

NFC stands for near -field communication, and is what makes contactless payments with your smartphone possible. The technology is based on RFID and allows two devices to communicate when they come into close proximity with each other.

NFC stands for near -field communication, and is what makes contactless payments with your smartphone possible. The technology is based on RFID and allows two devices to communicate when they come into close proximity with each other.

The same technology behind smartphone payments is also being applied to other electronic devices, particularly wearable technology, such as fitness trackers and watches. NFC mobile payments are dynamically encrypted, making them one of the most secure ways to make a payment. Most people carry their smartphone around with them, so it’s inevitable that paying with them will soon become the norm. It’s a very easy and convenient way to make payments.

How Secure Are Contactless Payments?

People are starting to trust contactless payments now that they are becoming more normal. Contactless payments are capped in most countries, and anything over the set spending limit will need to be paid for via chip and PIN or cash for additional security. However, America is one of the few countries that doesn’t currently have a limit, which may change once more people start to use it. Some countries and banks will also require chip and PIN to be used after a certain amount of contactless payments to increase security.

If your card is stolen, it’s possible that your money can be spent using contactless payments, so it’s important to freeze or cancel your card as soon as you realize. Your money should be protected by your bank in the event of this happening. Paying with smartphones offers an extra level of security, as your phone will usually need a PIN, password, fingerprint, face or iris scan to unlock and access payments, so even if your phone falls into the wrong hands your money will be secure.

Apps For Better Budgeting

‘Mint’ is one of the best apps for budgeting and tracking your spending. Available in America and Canada, you can connect all of your accounts so that everything is in one convenient place. Mint will remind you when your bills are due, how much they are and how much you have available. You can get reminders to make payments before late fees are charged, which total a whopping $23 billion a year, as well as see your real-time credit score.

Based on all of the information the app gathers, it can offer you personalized advice to help you manage your budget. The app ‘You Need A Budget’ (YNIB) is ideal for getting people out of debt, forcing you to budget with the money you actually have, based on your income. You can also get apps for saving your money, trading cryptocurrency, investing and, of course, making payments.

The Benefits Of Online Banking

Online banking has been around for a while now, with 62% of Americans using digital banking as their primary method of banking, according to creditcards.com.

Online banking has been around for a while now, with 62% of Americans using digital banking as their primary method of banking, according to creditcards.com.

Online banking apps have made accessing your accounts on the go even easier. As well as the obvious benefits, banks are adding more and more features to their apps as competition heats up from competing online-only banks. Many banking apps now offer 24/7 support and the ability to freeze and unfreeze your cards at the touch of a button, which is helpful if you think you’ve lost your card. Some can also remind you what your PIN is in the event that you forget it, using your password or the touch ID on your smartphone. You can also access the account types and information about all the services and products on offer, as well as switching to them or opening an account without having to step foot into your local bank, saving you a huge amount of time.

Online-Only Banking

Online-only banking revolves around using apps and websites to access and manage your money, with absolutely no physical banks involved. The people behind these are saving a fortune by doing it all online, which means they can offer you some additional perks to your regular high-street bank. They usually offer higher interest rates on your savings and have more tech-based features.

Traditional banks are likely to make use of some of the features, but you’ll get them first with online-only banks that are more invested in the technology, as has already been seen with the freeze and unfreeze card options. Online-only banks are still fairly new and will expand into more areas of banking as they become more popular. Some already offer mortgages, home equity, and auto loans, done completely online. Fintech companies have helped develop systems and applications to make payments and other financial transactions online faster, easier, and more secure.

Embracing technology can make managing your money a lot easier, more convenient, and save you time. You can make secure contactless payments, get yourself out of debt and save up for a rainy day. It’s understandable to feel apprehensive about adopting some of the technologies, especially if you’re used to cash and going into banks to sort out your finances, but whether we like it or not, technology is here to stay.